The world of online trading can feel like a vast and intricate landscape, filled with a plethora of platforms vying for your attention. Among them stands InstaForex, a name that has garnered both praise and curiosity from aspiring and seasoned traders alike. But is InstaForex the right fit for you?

This comprehensive review delves into the intricate details of InstaForex, offering a balanced perspective to guide your decision-making process. Whether you’re a complete beginner taking your first steps into the trading arena or an experienced trader seeking new avenues, this review aims to equip you with the knowledge you need to navigate the world of InstaForex with confidence.

Diving into the Details: What Does InstaForex Offer?

InstaForex caters to a diverse range of traders by offering a variety of account types. From the beginner-friendly “Insta Standard” with a mere $1 minimum deposit to the “Insta Eurica” designed for institutional traders, there’s an option tailored to suit your specific needs and risk tolerance. Each account type boasts varying features, such as spreads, leverage, and swap rates, so it’s crucial to choose the one that aligns with your trading style and goals.

Beyond account options, InstaForex boasts a diverse selection of trading instruments. Forex pairs, the bread and butter of online trading, are well-represented alongside Contracts for Difference (CFDs) on stocks, indices, and commodities. For those seeking unique offerings, InstaForex throws in the mix InstaFutures and synthetic securities, catering to a wider range of trading strategies.

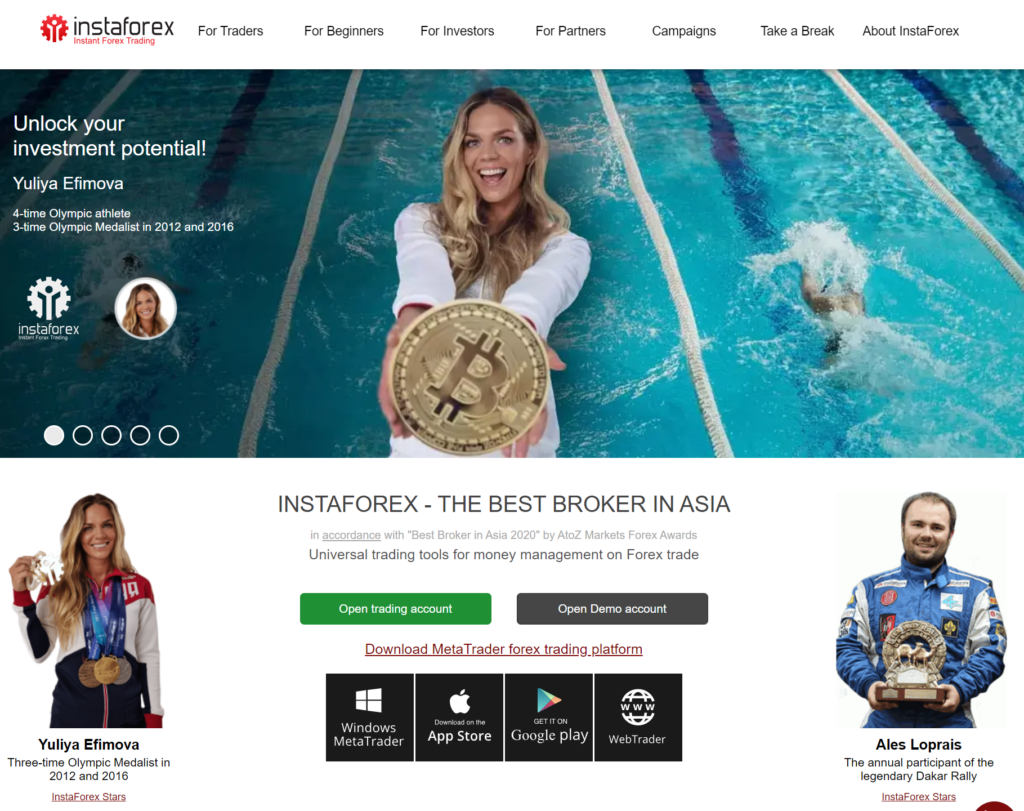

The trading experience at InstaForex is facilitated by a choice of platforms. MetaTrader 4, a widely popular platform known for its user-friendly interface and extensive customization options, is available alongside the more modern cTrader platform, lauded for its advanced charting tools and algorithmic trading capabilities.

Recognizing the importance of education, InstaForex provides a plethora of resources to empower traders of all experience levels. Webinars, tutorials, and market analyses equip individuals with the knowledge and skills necessary to navigate the ever-changing market landscape.

Should you encounter any challenges or have questions along the way, InstaForex offers multilingual customer support available 24/7 via live chat, email, and phone. This ensures that you receive timely assistance whenever needed.

Unveiling the Pros and Cons: A Balanced Perspective

Every platform has its own set of advantages and disadvantages, and InstaForex is no exception. Here’s a closer look at both sides of the coin to help you make an informed decision.

Advantages of Using InstaForex:

- Low minimum deposit: The $1 minimum deposit for the “Insta Standard” account makes InstaForex an attractive option for beginners who want to test the waters of online trading without a significant financial commitment.

- Diverse trading instruments: With a wide range of Forex pairs, CFDs, and unique offerings like InstaFutures, InstaForex caters to various trading strategies and preferences.

- Choice of trading platforms: The availability of both MetaTrader 4 and cTrader allows traders to choose the platform that best suits their trading style and technical expertise.

- Extensive educational resources: Webinars, tutorials, and market analyses empower traders of all experience levels to gain valuable knowledge and hone their trading skills.

- 24/7 multilingual customer support: Having access to prompt assistance, regardless of the time zone or language barrier, provides peace of mind to traders.

Disadvantages to Consider:

- Limited regulatory oversight: Depending on your location, InstaForex may operate under less stringent regulations compared to other brokers. It’s crucial to research the regulatory framework in your jurisdiction before proceeding.

- Potential platform limitations: While both MetaTrader 4 and cTrader offer a comprehensive set of features, some advanced traders might find limitations compared to more specialized platforms.

Security and Regulations: Building Trust in the Trading Arena

InstaForex implements various security measures to protect user data and funds. These include secure socket layer (SSL) encryption for data transmission and segregated accounts to keep client funds separate from company funds. While the specific regulatory framework under which InstaForex operates may vary depending on your location, it’s essential to conduct your own research to understand the level of oversight and protection offered in your jurisdiction.

Is InstaForex Right for You? Making an Informed Decision

Ultimately, the decision of whether or not InstaForex is the right platform for you hinges on your individual needs and goals as a trader. Consider your experience level, risk tolerance, desired features, and regulatory environment before making a choice.

If you’re a beginner seeking an affordable platform with a diverse range of instruments and educational resources, InstaForex might be a suitable starting point. However, if you’re an experienced trader requiring a highly regulated environment or a platform with more advanced features, you might need to explore other options.

Conclusion: A Final Verdict on InstaForex

InstaForex offers a compelling proposition

with its diverse account options, a wide range of trading instruments, and the option of popular trading platforms like MetaTrader 4 and cTrader. However, the potential drawbacks of limited regulatory oversight depending on location and potential platform limitations for highly experienced traders necessitate careful consideration before diving in.

To ensure you make an informed decision, thoroughly research the platform, understand the regulatory framework in your jurisdiction, and assess how well InstaForex aligns with your individual trading goals and risk tolerance.

Frequently Asked Questions (FAQs):

1. How do I open an InstaForex account?

Opening an InstaForex account is a straightforward process. Visit the official InstaForex website, click on the “Open Live Account” button, choose your desired account type, fill out the registration form, verify your account, fund your account using a preferred deposit method, download and install your chosen trading platform, and start exploring! Remember, this is a general guide, and specific steps may vary depending on your location and chosen account type.

2. What are the fees associated with trading on InstaForex?

InstaForex charges various fees, including spreads, commissions, and swap rates. These fees can vary depending on the account type, trading instrument, and market conditions. It’s crucial to carefully review the fee structure before opening an account.

3. What deposit methods does InstaForex offer?

InstaForex offers a variety of deposit methods, including bank transfers, debit/credit cards, e-wallets, and cryptocurrency. The availability of specific methods may vary depending on your location.

4. Does InstaForex offer a demo account?

Yes, InstaForex offers a free demo account that allows you to practice trading with virtual funds in a simulated market environment. This is a valuable tool for beginners to familiarize themselves with the platform and test their trading strategies before risking real capital.

5. Is InstaForex a safe and reliable broker?

While InstaForex implements security measures to protect user data and funds, the level of regulatory oversight may vary depending on your location. It’s vital to conduct your own research to understand the regulatory framework in your jurisdiction and assess the potential risks involved before investing any funds.

Step-by-Step Guide to Opening an InstaForex Account:

Here’s a concise guide to opening an InstaForex account:

- Navigate to the official InstaForex website: You can find the website through a simple search engine query.

- Locate the account opening section: Look for a button or link labeled “Open Live Account” or “Start Trading.”

- Choose your account type: InstaForex offers various account options, each catering to different needs and experience levels. Carefully review the features and limitations of each type before making your selection.

- Complete the registration form: Provide accurate and complete personal information, including your full name, email address, phone number, and country of residence.

- Verify your account: InstaForex requires account verification to comply with security regulations. This typically involves submitting documents like government-issued ID and proof of address.

- Fund your account: Select your preferred deposit method from the available options, such as bank transfer, debit/credit card, e-wallet, or cryptocurrency (availability may vary based on location). Follow the on-screen instructions to complete the deposit process.

- Download and install the trading platform: InstaForex offers both MetaTrader 4 and cTrader platforms. Choose the one that best suits your needs and download it from the official website. Once downloaded, follow the installation instructions.

- Launch the platform and log in: Use the login credentials provided by InstaForex (typically your account number and password) to access the platform.

- Explore the platform and familiarize yourself with its features: Take time to navigate the platform, understand the various tools and functions, and practice placing simulated trades before risking real capital.

Important Note: This is a general guide, and specific steps or requirements may vary depending on your location and chosen account type. Always refer to the official InstaForex website for the latest information and detailed instructions. Additionally, remember that online trading carries inherent risks, and it’s crucial to conduct thorough research and understand the potential risks before investing any funds.

Leave a Reply